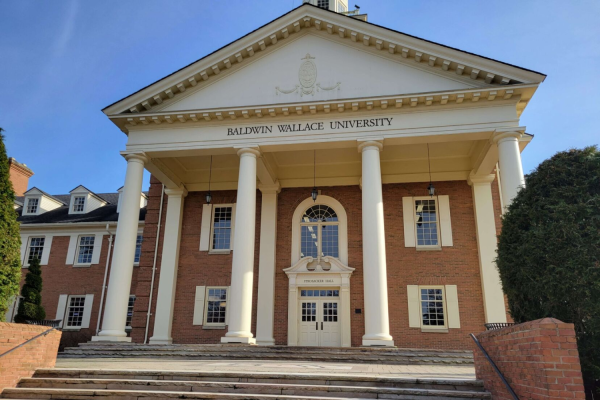

Students and alumni may receive up to $20,000 as part of Biden’s student debt relief plan

Approximately 45 million Americans have student loan debt and Americans owe $1.7 trillion in student debt nationally.

In late August, President Joe Biden’s administration announced the rollout of his plan to eliminate $10,000 of debt for those who have taken out federal student loans and earn under $125,000 a year or $250,000 a year for households, allowing many Baldwin Wallace students and alumni to potentially save thousands of dollars.

Borrowers will be eligible to receive up to $20,000 of relief if they are recipients of the Pell Grant, a need-based grant that aids lower-income undergraduate students.

The cutoff date for loans eligible for relief is June 30; any loans taken out after that date will not be eligible for the program.

There have already some ways that students have been able to pay off their student loan debt, BW financial aid counselor Laura Boswell said. Biden’s student loan debt forgiveness plan goes even further.

“There are multiple programs out there to help pay for student loan debt, but [Biden’s plan] is expansive and will cover more,” Boswell said. “I think it’s great that students who are Pell Grant eligible are getting double the amount; everybody [within the eligible income bracket] will get something, but those who demonstrate extra need are getting more.”

Politically, response to the program has been mixed among Congress; many Democrats have approved of the plan while simultaneously advocating for greater expansion of it, arguing for at least $50,000 worth of cancellation. Meanwhile, some Republicans were calling for the withdrawal of the plan entirely.

An application to receive loan forgiveness will launch by early October, and borrowers can expect to receive relief within four to six weeks of filling out an application, the U.S. Department of Education said in an August press release. Anyone who wants to apply for loan forgiveness before the payment pause ends should do so by Nov. 15, the Department of Education said.

“I’m curious how this is going to roll out and what the application is going to be like,” Boswell said. “Our hope is that the people who are eligible will be able to find the application and apply for it easily.”

In early 2020, a pause was put on student loan payments due to the financial strain the Covid-19 pandemic put on many Americans. The pause has been extended several times since then and was recently extended again through Dec. 31. Student loan payments are set to resume in January 2023.

Approximately 45 million Americans have student loan debt and Americans owe $1.7 trillion in student debt nationally. The cost of college has been steadily increasing at a rate higher than the rate of inflation, with some estimates setting the average cost of tuition as over 700 percent higher today than in 1970 when adjusted for inflation.

“The important thing to remember when you’re weighing taking out a loan, whether it be for an education, a car, a house, etc. is to make sure that the debt you incur doesn’t exceed the benefit of your investment,” Boswell said. “It’s different for each person and family, so it’s an important conversation to have as you’re weighing taking out a loan.”

More information about the student loan relief plan can be found at studentaid.gov.

The Exponent is looking for financial contributions to support our staff and our newsroom in producing high-quality, well-reported and accurate journalism. Thank you for taking the time to consider supporting our student journalists.